Looking for a quick loan? Then you might have heard about the “Red Arrow loan”. Sometimes we require urgent loans and fall for the easiest way to get a loan. You take loans without checking about the company, the interest they charge on you and what are their repayment terms.

It is observed that some lenders or mediators who can bring a lender for a loan and offer quick process loans usually have high interest rates and some hidden charges. Sometimes these types of decisions can push us into a financial crisis.

In this article, we will honestly review “Red Arrow Loan”. At the end of the article, you can decide whether you should use the Red arrow for loans.

Also Read: Credit Sage Legit or Not?

Table of Contents

What is Red Arrow Loans

Red Arrow loans are the mediator between you and many lenders. It connects you with the lenders who offer loans. Note that Red Arrow Loans are not direct lenders. They offer quick personal loans ranging from $500 to $5,000.

The convenience of getting funds deposited directly into your bank account in as little as one business day makes them appealing when you need money now.

They can offer you a loan of up to 5000$. To get a loan from them you just need to fill out their online form. Red Arrow will ask you for documents after filling out the online form they will share your data with the lenders. After that, you will receive offers from multiple lenders, and if you accept certain terms and conditions of the lender and agree to the loan. Red Arrow will provide the loan amount in your bank account.

Red Arrow Loan Legit?

To conclude whether a company is legit or not we check its website, a physical address. On the website of Red Arrow, we have not found any physical address also we have not found any contact number. After doing a deep research we cannot find the owner of Red Arrow Loan.

We also checked reviews of Red Arrow Loans We have found some major red flags.

Red Flags in Red Arrow Loan

When looking for financial services from a company it is very important to look at the negative aspects of the company. We have found some basic points are missing from the Red Arrow Loan website.

- No About Us page on the Website.

- No Founder details are provided.

- No Physical Address is mentioned on the Red Arrow loans website.

Eligibility to Get Red Arrow Loan

Every loan provider has some set of eligibility to offer you a loan. To get a loan you must fulfill the requirements. Here are the Red Arrow Loan Requirements listed.

- You must be 18.

- You should be a US resident with valid ID proofs.

- A minimum salary of 1000 $.

- An active bank account.

Pros of Taking Loan From Red Arrow Loan

Are there any benefits to taking loans from the red arrow? Let’s have a look at the benefits of this.

- Your Credit Score doesn’t matter.

- Quick and easy. Online application process.

- They will bring lenders for you.

- They do not charge any fees to you.

- You will get the loan amount directly into your account.

Cons of Taking Loan From Red Arrow Loan

It depends on your decision and your research whether you take loans from the Red Arrow Loan or not.

We have found some cons if you take a loan from Red Arrow ;

- They offer short-term loans. Similar to a Payday Loan.

- Not available in every state of the United States.

- They are not a direct lender

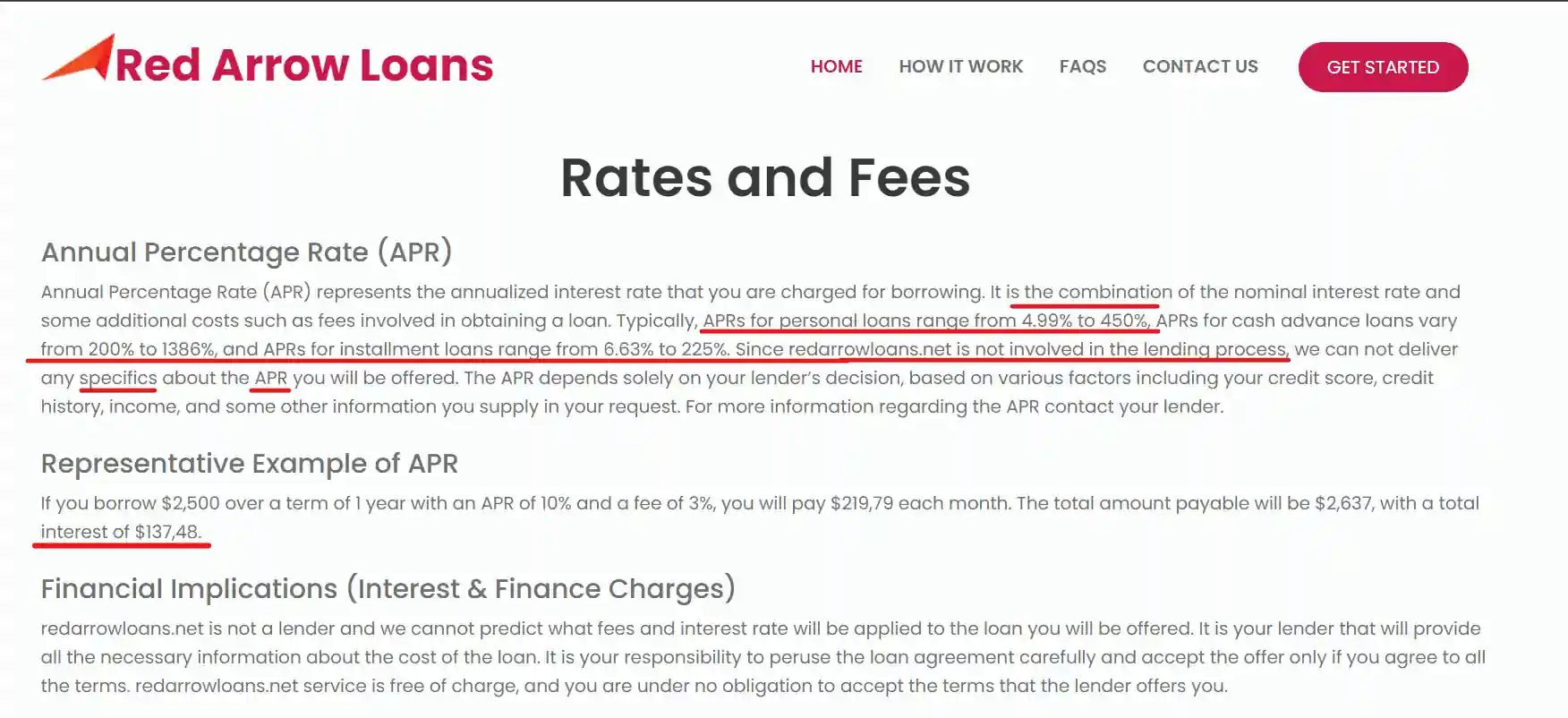

- High-Interest rate.

- Loan terms not determined by Red Arrow.

Review of Red Arrow Loan

We have gone through the various social media platforms to check reviews. Surprisingly we have found that there are negligible reviews. Many of them are suggesting to not apply for red arrow loans.

A user reported that after submitting an online form he received many emails and Calls from lenders as well as from the red arrow loans after unsubscribing.

Receiving calls and emails for loans is expected but when you are bombarded with 2000-3000 emails within 3-5 days you will be frustrated.

Should You Take Loans From Red Arrow Loans

It depends on your requirements whether you should take a loan from them or not.

They do not mention interest rates and other necessary details such as repayment schedules, late fee charges, and other charges of loans.

As they are not a lender you have to read many lenders’ offers carefully one of which can be a time-consuming process.

Therefore there could be the possibility of some hidden charges.

- Check interest rate: they are offering loans with very high interest rates.

- High Fees

- Hidden Charges

- Repayment structures and fees.

However, I would prefer to contact other direct reputable lenders for loans.

Also Read: 405 Howard Street San Francisco Charge on Credit Card

Conclusion

We have not found more reviews about the “Red Arrow Loan”. So it seems like a legit website, however, there could be a potential for a scam. So try to find out better options than Red Arrow Loans.