Credit and debit cards have significantly impacted payment processing, with cash accounting for only 20% of transactions. However, with 2.8 billion cards globally, fraudsters have a significant opportunity.

Merchants must understand the scope of credit card fraud to protect their businesses and ensure secure transactions. Key statistics show that 46% of global fraud occurs in the US, and losses will exceed $12.5 billion by 2025.

How to Pay My Cricket Bill with Debit Card?

Have you or someone you know ever been tricked by a credit card scam? Credit card scammers are experts at using sneaky tricks to steal money and hurt people’s finances.

To keep you safe, we’ve put together this simple guide that explains how scammers do it.

Credit card scams continue to evolve with technology, presenting new tricks for scammers to catch the public off guard.

Credit card fraud occurs when someone uses stolen card information to make unauthorized purchases in your name.

Table of Contents

How Credit Card Scam Works

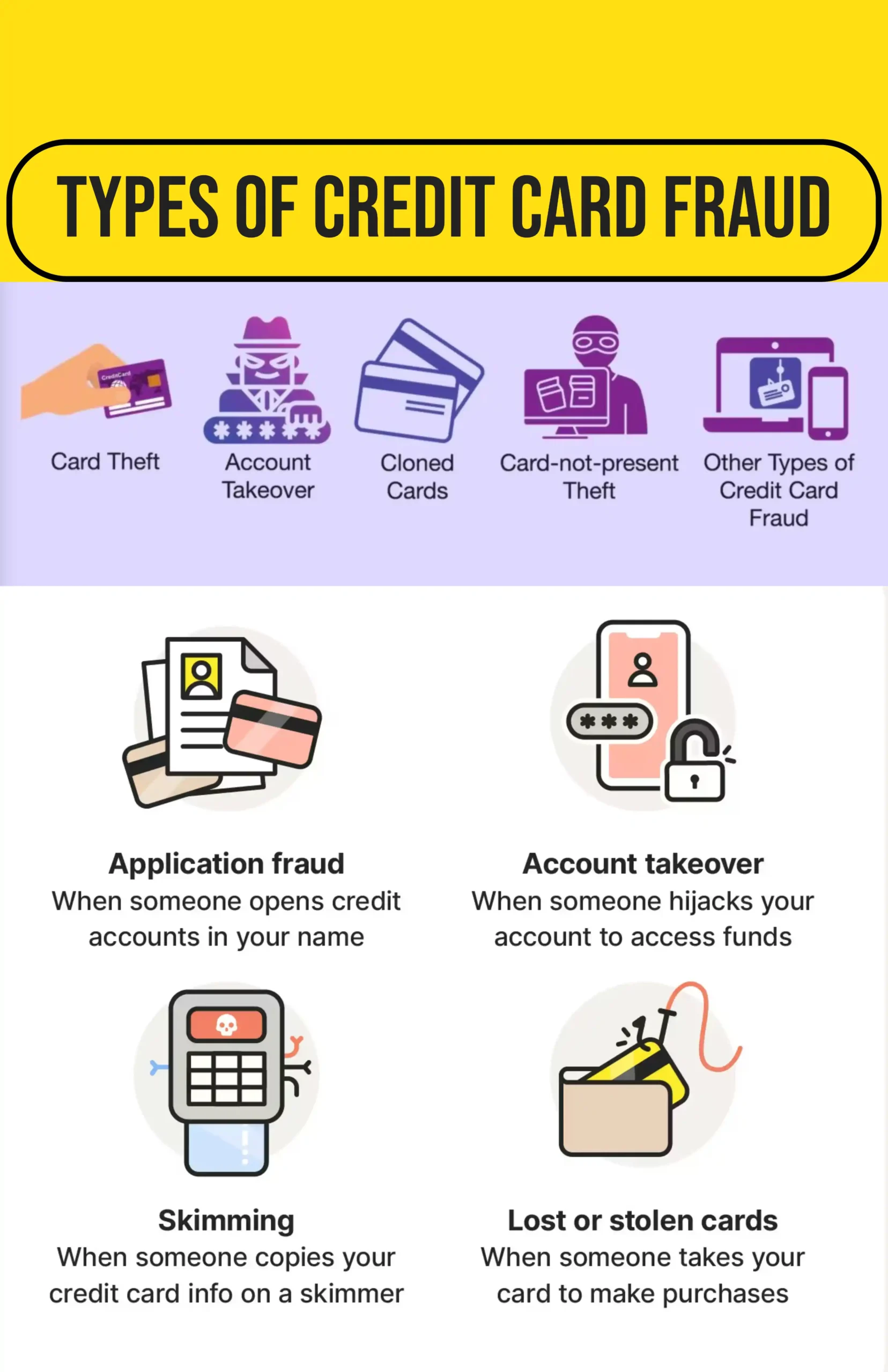

Credit card theft and fraud can occur in various ways, including lost or stolen cards, card-not-present fraud, counterfeit, doctored, or faked cards, application fraud, account takeover, and intercepting cards in the mail.

Criminals can obtain card details through lost or stolen cards, card-not-present fraud, counterfeit cards, application fraud, account takeover, and social engineering.

They can use the card details to make purchases online, mail, or call a credit card company to register a change of address. Skimmers can also illegally obtain card details through magnetic strip capture. It is crucial to be cautious when handling card details to prevent theft and fraud.

Types of Credit Card Scam

Credit card fraud can occur online, over the phone, in text, or in person, and can involve fake emails, data breaches, or card theft. To protect yourself, be aware of different types and be cautious, while solid prevention isn’t guaranteed.

Credit card scams specifically target individuals’ credit card information and can lead to unauthorized charges, identity theft, and financial losses. Here are some common types of credit card scams.

Interest Rate Reduction Scams:

Scammers promise to lower credit card interest rates for a fee, but they often do nothing or provide fake services, leaving victims with additional debt.

Robocall scams involve claiming to have inside connections to credit card companies to negotiate lower interest rates on credit card balances. These scams often involve a caller claiming to have inside connections to lower payments, but there are no such connections.

The caller then asks sensitive questions to harvest personal data. In some cases, the caller contacts the credit card company and successfully lowers the rate, charging the victim hundreds or thousands of dollars.

“Cup Loan Program is legit or a scam ?”

Phishing Scams:

Scammers send fake emails or messages that appear to be from legitimate sources, asking recipients to provide their credit card details, often under the guise of updating account information or resolving an issue.

Card Not Present (CNP) Fraud:

Scammers use stolen credit card information to make online or phone transactions where a physical card is not required. This type of fraud is common in e-commerce and over-the-phone purchases.

Card Skimming:

Criminals install devices, called skimmers, on ATMs, gas pumps, or point-of-sale terminals to capture credit card information from unsuspecting victims when they swipe their cards.

Lost or Stolen Card Fraud:

If your credit card is lost or stolen, scammers may quickly use it to make unauthorized purchases until you report it missing.

Application Fraud:

Scammers apply for credit cards using stolen personal information. They rack up charges on these cards, leaving victims to deal with the consequences.

Preapproved Credit Card Scams:

Scammers contact individuals with offers of preapproved credit cards, often requiring an upfront fee. After receiving the fee, they either provide fake cards or disappear altogether.

Card Not Received Scams:

Scammers intercept legitimate credit cards in the mail and activate them without the cardholder’s knowledge, using them for fraudulent transactions.

Fake Credit Card Offers:

Scammers send fake credit card offers that require an upfront fee or deposit. Once they receive the payment, they disappear without providing any card.

Credit Card Account Takeover:

Scammers gain access to a victim’s existing credit card account, change the contact information, and make unauthorized purchases.

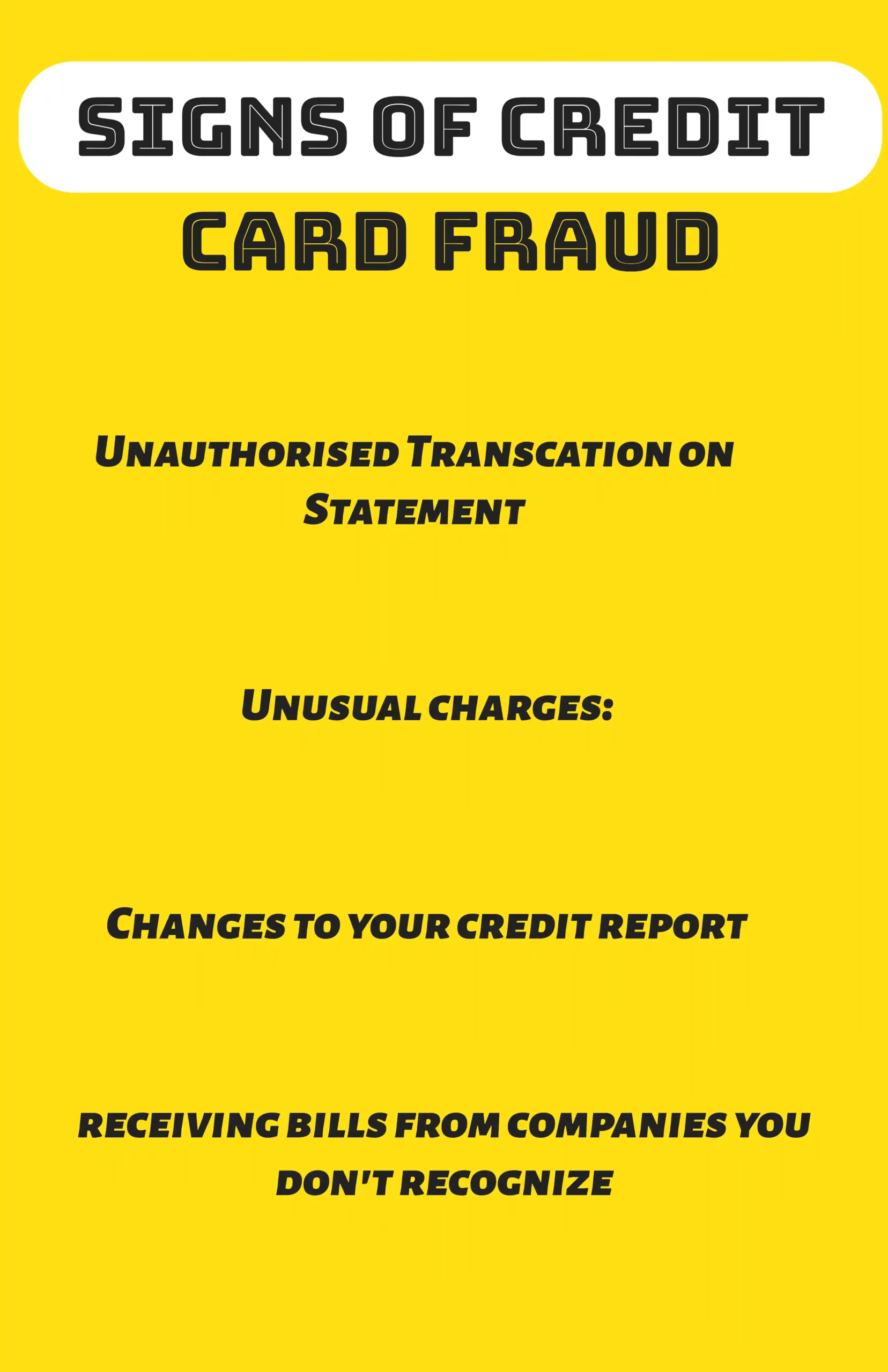

Signs to Credit Card Scams

How do you know that I’m scammed by a scammer on my credit card? In the early stage if scams are identified these credit scams can be prevented. Here are early signs of credit card scams.

Credit card scams can happen in many ways, but there are common signs and red flags you should be aware of to protect yourself from falling victim to these scams. Here are some key signs of credit card scams:

Unauthorized Charges: Check your credit card statements for any unauthorized or suspicious charges. If you notice unfamiliar transactions, contact your credit card issuer immediately.

Phishing Emails or Calls: Be cautious of unsolicited emails, messages, or phone calls requesting your credit card information. Scammers may pose as banks, credit card companies, or even government agencies to trick you into providing sensitive information.

Fake Credit Card Offers: Be skeptical of offers that seem too good to be true. Scammers may send fake credit card offers that promise low interest rates, high credit limits, or guaranteed approval. Always verify the legitimacy of such offers with the issuing bank.

Pressure to Act Quickly: Scammers often create a sense of urgency, pressuring you to make quick decisions. They may claim your credit card is compromised and urge you to provide information immediately. Take your time to verify the legitimacy of such requests.

Insecure Websites: Before entering your credit card information online, ensure that the website is secure. Look for “https://” in the URL, a padlock symbol in the address bar, and a trustworthy website design.

Card Skimming Devices: Be cautious when using ATMs or card readers, especially those in unfamiliar or poorly lit locations. Criminals may install skimming devices that capture your card information. Inspect card readers for any irregularities before using them.

Unsolicited Card Replacement: If you receive a new credit card in the mail that you didn’t request, contact your issuer immediately. It could be a sign that your card information has been compromised.

Unexpected Text Messages: Scammers may send text messages claiming to be from your bank and asking you to click on a link or call a number. Always verify such messages by contacting your bank directly using the official contact information.

Social Engineering: Scammers may gather information about you from social media or other sources to impersonate you when contacting your bank. Be cautious when providing personal information, even if someone seems to know a lot about you.

Unfamiliar Merchants: Review your credit card statements for unfamiliar merchant names or descriptions. Some scammers make small test transactions to verify if a card is active.

Check Your Credit Report: Regularly check your credit report for any accounts or inquiries that you don’t recognize. This can be a sign that someone has used your identity to open fraudulent accounts.

Monitor Your Credit Score: A sudden drop in your credit score could indicate that someone has opened new credit accounts in your name.

Lost or Stolen Card: Report a lost or stolen card to your issuer immediately to prevent unauthorized use.

If you suspect that you’ve fallen victim to a credit card scam, contact your credit card issuer and local law enforcement right away. Prompt action can help limit the damage and prevent further fraudulent activity. Additionally, consider putting a fraud alert or credit freeze on your credit reports to protect your financial information.

How to Avoid Credit Card Scams

Avoiding credit card scams requires vigilance and caution. Here are some steps you can take to protect yourself from credit card scams:

- Keep Your Credit Card Secure:

- Store your credit cards in a secure wallet or cardholder.

- Don’t leave your cards unattended or visible in your car.

- Be cautious about sharing your card with others, even friends and family.

- Use EMV Chip Cards:

- Use credit and debit cards equipped with EMV (chip) technology, which provides stronger security compared to magnetic stripe cards.

- Check Card Readers and ATMs:

- Inspect card readers and ATMs for any signs of tampering, such as loose or damaged parts, unusual protrusions, or extra attachments.

- If something looks suspicious, don’t use the machine and report it to the owner or authorities.

- Cover Your PIN:

- Shield the keypad with your hand when entering your PIN at ATMs or payment terminals to prevent cameras or hidden devices from recording it.

- Be Cautious with Your Information:

- Never share personal or financial information, such as your credit card number or Social Security number, via email or phone unless you initiated the contact and are sure it’s legitimate.

- Don’t respond to unsolicited requests for your personal information.

- Use Strong, Unique Passwords:

- Create strong and unique passwords for your online accounts, especially those related to your credit cards.

- Enable two-factor authentication (2FA) whenever possible to add an extra layer of security.

- Monitor Your Accounts Regularly:

- Review your credit card and bank statements regularly for unauthorized transactions.

- Set up transaction alerts so you’re notified of any suspicious activity immediately.

- Beware of Phishing Attempts:

- Be cautious of unsolicited emails or messages, especially those requesting personal information or asking you to click on links.

- Verify the legitimacy of emails and websites by independently contacting the organization using official contact information.

- Verify Caller Identity:

- If you receive a phone call requesting personal or financial information, ask for the caller’s name, organization, and a call-back number. Verify their identity independently before sharing any information.

- Educate Yourself:

- Stay informed about common scams and tactics used by scammers. Awareness is your best defense.

- Report Suspicious Activity:

- If you suspect any fraudulent activity or encounter a potential scam, report it to your credit card issuer, bank, or the appropriate authorities immediately.

What to do if a Credit Card Scam happens to me?

If you become a victim of a credit card scam, it’s essential to take immediate action to minimize the potential damage and resolve the situation. Here are the steps to follow:

- Contact Your Credit Card Issuer or Bank:

- Call the customer service number on the back of your credit card or your bank statement. Report the fraudulent activity and inform them that your card has been compromised.

- Request that your credit card be temporarily blocked or canceled to prevent further unauthorized transactions.

- Change Your PIN and Passwords:

- If your PIN or any online account passwords were compromised, change them immediately to prevent further unauthorized access to your accounts.

- Review Your Statements:

- Carefully review your credit card and bank statements to identify all unauthorized charges and transactions.

- Document the fraudulent transactions with details such as dates, amounts, and merchant names.

- Dispute Unauthorized Charges:

- Inform your credit card issuer or bank of the unauthorized charges and request that they investigate and remove them from your account.

- Most financial institutions have a process for disputing charges. Follow their instructions and provide any requested documentation to support your case.

- File a Police Report:

- Contact your local law enforcement agency and file a police report regarding the credit card scam. This report may be required by your credit card issuer or bank to confirm the fraud.

- Be sure to obtain a copy of the police report or a case number for your records.

- Place a Fraud Alert or Credit Freeze:

- Consider placing a fraud alert or credit freeze on your credit reports with the major credit bureaus (Equifax, Experian, and TransUnion). This can help prevent further fraudulent accounts from being opened in your name.

- Monitor your credit reports for any additional suspicious activity.

- Notify the Federal Trade Commission (FTC):

- Report the scam to the FTC at ftccomplaintassistant.gov. This information helps law enforcement agencies track and combat fraud.

- Keep Records:

- Maintain records of all communications and documents related to the scam, including correspondence with your credit card issuer, bank, and law enforcement agencies.

- Stay Vigilant:

- Continue to monitor your financial accounts regularly for any unusual activity, even after resolving the immediate issue.

- Be cautious about sharing your personal information to prevent future scams.

- Educate Yourself:

- Learn from the experience and educate yourself about common scams and fraud prevention measures to avoid becoming a victim in the future.

Remember that acting swiftly is crucial when dealing with a credit card scam. The sooner you report the fraud and take steps to address it, the better chance you have of minimizing the financial impact and protecting your credit.

The Conclusion Point

In conclusion, credit card scams are a real threat, but you can protect yourself. Be careful with your credit card information, watch out for suspicious emails and offers, and check your statements. If you ever suspect a scam, act quickly by contacting your card issuer and the authorities. Stay informed and vigilant to keep your money safe.

If you find this article Valuable kindly share it with your friends and family.