Need a quick loan? It’s important to choose a transparent lender who clearly outlines the fees and repayment terms. If you’re looking for a review of Fast Loan Advance, stay with us. In this article, we’ll uncover the truth about the legitimacy of Fast Loans and explore the pros and cons of taking out a loan.

What should you consider before choosing a lender? If you don’t choose wisely, you could end up in a scam or face financial trouble.

Table of Contents

What is Fast Loan Advance

Fast Loan Advance is an online lending platform that provides consumers with short-term loans in times of need when prompt financial assistance is needed it can be an emergency where consumers need urgent and quick money without paperwork. It offers minimal paperwork and easy money dispatch to consumers making it more attractive.

The main selling point of Fast Loan Advance is its speed. The company promises loan approval in minutes, with funds transferred within 24 hours. This is much faster than traditional banks, which require lots of paperwork and take a long time to process loans. The fast approval process is possible thanks to technology that quickly assesses creditworthiness and approves loans.

How Fast Loan Advance Works and Important Terms

Fast Loan Advance operates as a broker site, meaning it connects applicants with various loan companies. However, the specific lenders you may be matched with are not disclosed upfront, which adds some uncertainty.

Here are some key details to understand:

- The company behind Fast Loan Advance is registered as TpolTech, Inc.

- The loans offered through the platform come with APRs ranging from 5.99% to 35.99%, depending on the borrower’s qualifications.

- Repayment terms vary, with a minimum period of 91 days and a maximum of 72 months.

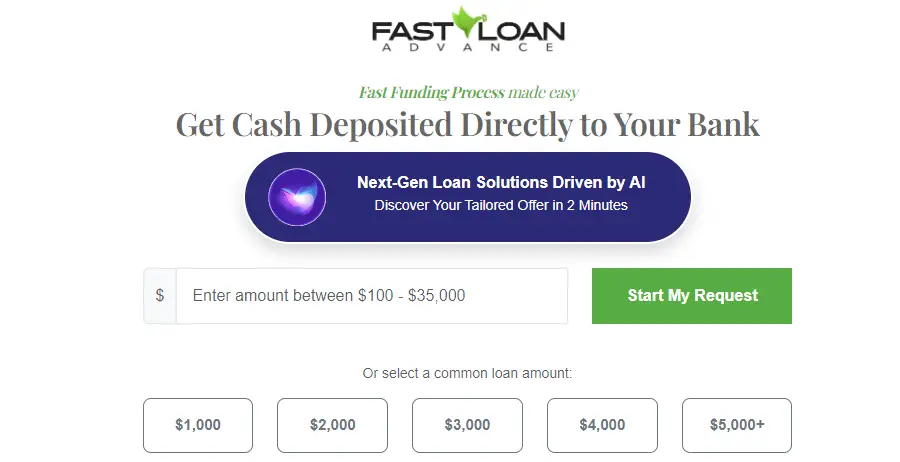

- You can apply for loans as small as $100 or as large as $35,000.

- Based on the information you provide, Fast Loan Advance will search for lenders that best match your criteria.

- To be eligible, applicants must be U.S. citizens and have a steady source of income to repay the loan.

As the loan amount increases, the interest rate tends to decrease. For example, the interest rate on a $1,000 loan could be as high as 24%, while a $10,000 loan might have a much lower rate of 8%.

It’s important to note that Fast Loan Advance does not directly handle the repayment process or set the APR (Annual Percentage Rate) on loans. A portion of the fees charged by the lender may go to Fast Loan Advance as a broker fee. For instance, you might pay 3% of the loan value on a $1,000 loan, while a 10% fee could apply on a $10,000 loan.

Fast Loan Advance Pros & Cons

Pros:

- Fast Loan Advance can help you find small loans starting at $100 or bigger ones up to $35,000.

- You don’t have to pay to use their service—it’s free.

- They may be able to help you get a loan even if your credit isn’t great.

Cons:

- You can only apply for loan offers through an online form; there’s no phone or in-person option.

- They say they work with many lenders, but don’t mention who these lenders are.

- There aren’t many reviews online about Fast Loan Advance.

Read Also: What is Modern Leasing Charge on Credit Card

What to Look for Before Selecting a Quick Payday Loan

Before choosing a quick payday loan, it’s important to know what you’re getting into. Payday loans can be helpful when you need money fast, but they often come with high fees and interest rates. Before selecting a lender always compare different lenders and understand the terms of the loan before you decide.

Important Things to Check:

- Interest Rates and Fees: Find out the total cost of the loan, including interest rates and any additional fees.

- Loan Terms: Understand how long you have to repay the loan and what happens if you can’t pay it back on time.

- Lender Reputation: Check reviews and ratings to ensure the lender is reputable and trustworthy.

- Application Process: Look for a straightforward application process that doesn’t require a lot of paperwork.

- Approval Time: Consider how quickly you can get the money after approval, especially if you need it urgently.

- Repayment Options: Make sure the lender offers flexible repayment options that work for you.

- Hidden Charges: Be aware of any hidden charges or penalties for late payments.

- Customer Sup

Now you know what to look for in a lender before borrowing money from them. You might be also wondering Is Fast Loan Advance Legit or another scam in the market. In today’s world money is important for everyone and with advancements in technology the number of scams increasing day by day so we must make ourselves safe from such types of scams. let’s Explore the legitimacy of the Fast Loan Advance.

Is Fast Loan Advance Legit?

It is very important to look for red flags if you are taking any type of quick loan. When you go to the website of Fast Loan Advance you will see there is no About Us or policy page. Also, there are no details available for the Interest Rate and Payback details.

For Quick lending money, they have t access to your personal details and bank details. The company is offering you up to $5000+ money in 24Hr.

Red Flags in Fast Loan Advance

The company is not registered and approved by any financial institution if it is approved they will mention on the website that they are approved by this institution.

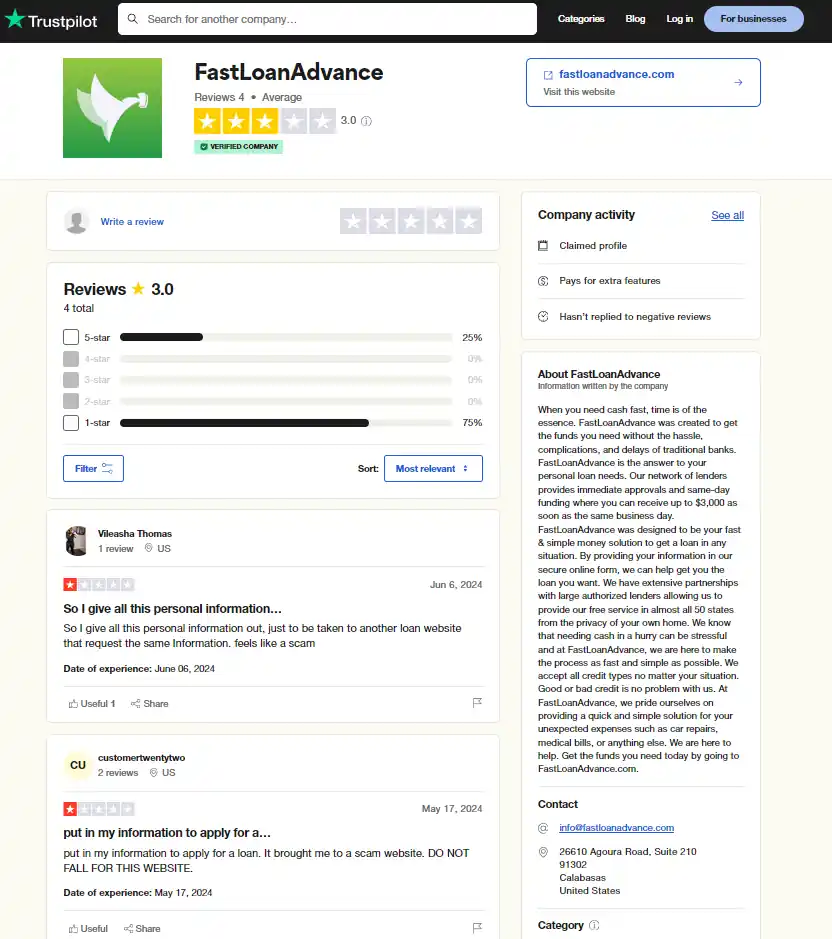

We have checked reviews for Fast Loan Advance on platforms like BBB and Trustpilot. On Trustpilot, the company has a 3-star rating with only four reviews, three of which say the company is a scam that collects personal information from consumers.

Our team also looked at Reddit for reviews and user experiences with Fast Loan Advance. There is only one subreddit discussing them, and it appears to be paid, with many users stating that they are a scam collecting personal details.

Now let’s see potential pros and cons if you are taking loans from it.

Pros & Cons of Fast Loan Advance

Pros of Fast Loan Advance

- Quick Access to Funds: Fast Loan Advance provides fast funding, which is helpful for emergencies.

- Flexible Repayment: The platform offers repayment options that can be tailored to individual needs.

- Extensive Lender Network: They have a large network of lenders, increasing the chances of loan approval.

- Confidential Process: The loan process is designed to be private and secure.

- Convenient Online Access: Everything can be done online, making it easy to apply for a loan from anywhere.

Cons of Fast Loan Advance

- High Interest Rates: The loans often come with high interest rates, which can increase the cost of borrowing.

- Potential Scams: There is a risk of scams, as some reviews suggest issues with legitimacy.

- Lack of Personalized Service: The service might not be tailored to individual customer needs, which could be a disadvantage for some borrowers.

Application Procedure of Fast Loan Advance

Fast Loan Advance makes applying easy with a simple online form. Just provide your basic personal and financial information, and they’ll do a quick credit check to evaluate your eligibility. If approved, the money is deposited directly into your bank account.

Fast Loan Advance stands out by accepting all credit scores, unlike traditional lenders. They consider applications from people with poor or no credit history, which is a big help for those who might not qualify elsewhere.

Workpoints Charge on Credit Card?

Interest Rates and Charges of Fast Loan Advance

While Fast Loan Advance is convenient, it can be costly. Short-term loan interest rates and fees are usually higher than regular loans. This is true for Fast Loan Advance, where APRs can be significantly higher because of the quick approval process and less strict credit checks.

User experiences with Fast Loan Advance are mixed. Some users like the platform for its friendly service, quick approvals, and ability to help during tough times. Positive reviews often come from those who successfully repay their loans without issues.

Regulatory Compliance and Security

Fast Loan Advance follows state and federal guidelines for short-term lending, including clear disclosure of loan terms, interest rates, and fees. They use standard encryption to protect personal and financial information. However, users should be cautious when sharing sensitive information online and ensure they use the official website to avoid scams or phishing.

Alternatives to Fast Loan Advance

It’s always smart to consider other options before settling with Fast Loan Advance. Depending on a person’s financial situation and needs, the following may be suitable alternatives:

- Credit Unions: Many credit unions offer short-term loan services at favorable rates with less interest compared to online lenders.

- Personal Loans from Banks: Traditional banks can offer personal loans with longer terms and lower interest, though they may also require better credit scores.

- Peer-to-Peer Lending: The borrower is matched through platforms such as LendingClub or Prosper with individual investors, who charge lower rates or provide better terms most of the time.

- Borrow from Friends or Relations: This could be possible but help from known people can often avoid the high cost of short-term borrowing.

Conclusion: Is Fast Loan Advance Legit?

The company may offer a real service, but it’s important to be cautious. They are not transparent about their terms and costs, and there are many reports of scams. Potential borrowers should fully understand the loan terms, interest rates, and fees before proceeding.

Always consider your financial situation to ensure you can repay the loan without falling into debt. It’s important to check alternatives and make an informed decision.

We cannot confirm the company is legit, so take a loan at your own risk.

Frequently Asked Question (FAQ)

What happens if you don’t pay back cash advance apps?

This can lead to ongoing efforts to recover the debt, which can be stressful and will probably show up on your credit record, which will negatively impact your credit and financing possibilities.

Is it bad to use cash advance apps?

Consider the potential difficulties before using a Cash Advance app. Risks to security and privacy. Apps providing cash advances need access to your bank account, contact details, and whereabouts. You run the danger of being a victim of fraud, identity theft, or hacking.