If you have seen “Quick Card San Diego CA” on your credit card statement? Mysterious transactions on a credit card statement can indeed cause anxiety and confusion. Our Finclash Team conducted online research to find out more details about the quick card charge.

Because of this, it’s critical to clarify charges like “Quick Card San Diego CA,” which are associated with QuickCard, a payment method that several companies use.

It’s a moment of perplexity that many of us have faced – a shopping spree, a blur of transactions, and then the sudden realization that we’re not entirely sure where our hard-earned money went.

Sometimes it happens that we shop and don’t remember the shop name and when we look at our credit card statement we get confused.

Also Read: Bridgepointe pus san mateo ca charge on credit card

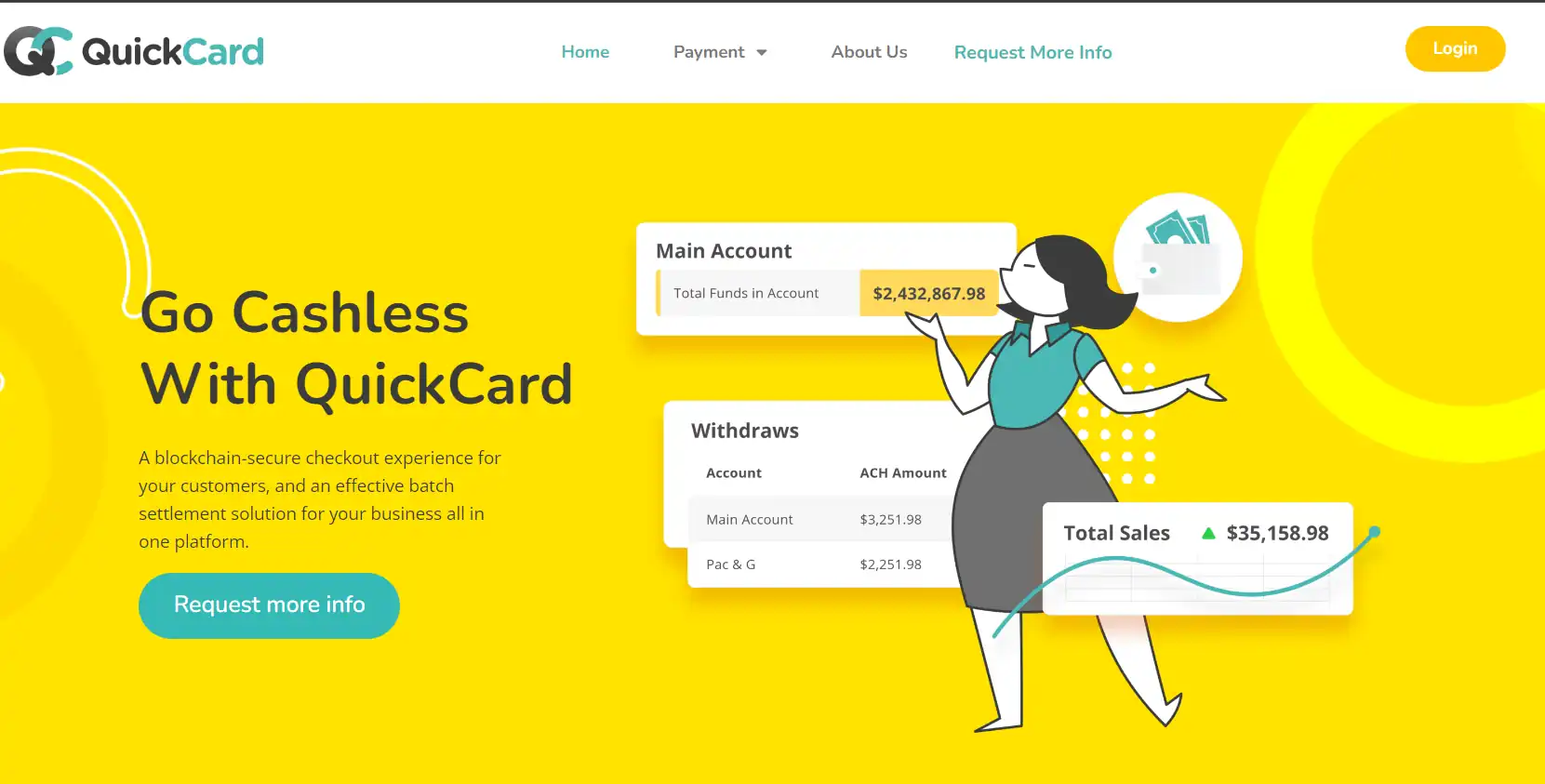

What is Quick Card

Quick Card is a blockchain technology-based payment system. The company is registered in San Diego, California United States. That’s why the charge on your transaction appears with the description “SAN DIEGO CA“.In simple terms, Quick card is a payment gateway technology used by many business owners and stores.

Quick card company was started in 2017 to make payment cashless faster and smoother.

This company is a business-to-business type (B2B). Its primary market is retail and E-commerce websites that want payment solutions.

Therefore, Quick Card does not charge customers directly.

Retailers or websites that use instant card payment infrastructure and when we make purchases from them. The charge may appear on your credit card with an instant card statement

Quick Card is Legit?

In our research, we found that the quick card is a legitimate company. It started in 2017. It offers payment solutions to retail on websites.

Here are the details of the quick card.

| Company Name | Quick Card |

|---|---|

| Official website | https://quickcard.me/ |

| Address | 3131 Camino Del Rio North Suite 1400 San Diego, CA 92108 |

What is Quick Card Charge on Credit Card

Earlier in the article we mentioned that this company offers payment solutions that are credit cards and automated Clearing House transfers to make easy payment processes for shops and websites. The charge description on your statement frequently includes “SAN DIEGO CA” because the company’s headquarters are in San Diego, California. Notably, cannabis retailers all around the country regularly use QuickCard.

Check what you have purchased from any shop or website.

Check your bill and match the amount with the statement. After that contact the merchant and ask them about the charge.

We found that the charge description varied differently. Here is the list of the charges appearing on customers’ credit cards. There are a few possible formats for the “Quick Card San Diego Ca Us” charge, and each one can suggest a distinct kind of transaction. Here is a list to assist you in recognizing them:

| Code | Description |

| QUICK CARD SAN DIEGO CA US | The full descriptor, often seen on detailed statements. |

| CHKCARDQUICK CARD SAN DIEGO CA US | Indicates the charge was made using a check card. |

| POS PURCH QUICK CARD SAN DIEGO CA US | Another format for Point of Sale purchases. |

| POS Debit QUICK CARD SAN DIEGO CA US | Indicates a Point of Sale debit transaction. |

Quick Card Charge is Legit?

If you have used your credit card at any website or shop that uses quick card payment infrastructure, in that case, the charges are valid.

To do that match the bill receipt and charge amount on the credit card. However, if you are 100% sure that this charge is not legitimate in that case someone else used your credit card.

This person may be a member of your family so make sure you ask them too.

It is possible that someone got your credit card details and used them.

- Matching Bill Receipts: Compare your bill receipts with the amount reflected on your credit card statement. Valid charges should align with your documented purchases.

- Credit Card Usage Confirmation: If you’ve used your credit card at a website or shop employing Quick Card payment infrastructure, the charges are likely valid.

- Unauthorized Charge Suspicions: If you are certain that the charge is not legitimate, someone else may have used your credit card. Investigate within your family and confirm no one else made the transaction.

How to Verify Quick Card Charges

If you’ve encountered a Quick Card charge on your credit card statement, follow these steps:

- Review Your Purchases: Examine your recent purchases from any shop or website. Cross-reference your bill with the statement to identify the source of the charge.

- Contact the Merchant: If the charge seems unfamiliar, reach out to the merchant associated with Quick Card. Inquire about the specific purchase to clarify any discrepancies.

Also Read: How to use Fintechzoom Mortgage Calculator

Conclusion

We have shared all the information related to quick card charges on credit cards.

Share your thoughts on this charge in the comment section.